In today’s digital world, financial transactions have transcended physical borders. Businesses and individuals are looking for payment solutions that are secure, efficient, and accessible worldwide. This is where Epay comes in.

Epay is a global payment gateway solutions provider that offers customized payment services for global businesses. With coverage in over 200 countries, support for 80 currencies, and over one million users, Epay has established itself as a key player in the payment gateway space.

But what exactly does Epay do? How has Epay managed to gain the trust of so many users around the world? To understand this, we must first understand what a payment gateway is.

Payment Gateways

A payment gateway is a service that is used to process payment transactions for online purchases. When you buy something online and choose to pay by credit or debit card, it is a payment gateway that verifies your card information, ensures that there are enough funds to cover the purchase, and then completes the transaction by transferring the funds from the buyer to the seller. All this happens in a matter of seconds.

Epay is one of these payment gateways, but with some unique features that set it apart. First, Epay is not limited to processing credit and debit card transactions. The platform offers a variety of payment services, including API gateways, currency exchange, and settlements.

Epay Coverage

Second, Epay has extensive global coverage. With a presence in over 200 countries and support for 80 currencies, Epay is truly a global payment solution. This means that no matter where you are or what type of currency you use, you are likely to be able to use Epay for your financial transactions.

In addition, Epay collaborates with major national banks and partners with Alipay, the digital payment solution, to provide secure, compliant, efficient, and convenient CNY settlement services for overseas users and cross-border merchants. This demonstrates Epay’s commitment to security and compliance, two crucial aspects of any financial transaction.

Epay with intuitive interface

Epay also prides itself on its ease of use. With an intuitive user interface and flexible payment options, Epay strives to make financial transactions as simple as possible for its users. In addition, Epay offers excellent customer service to help users with any issues or questions they may have.

In today’s digital age, online businesses are booming. From e-commerce to social media platforms, companies are looking for ways to streamline their operations and provide their customers with a seamless user experience. This is where Epay can play a crucial role.

Solutions for cross-border e-commerce

E-commerce has experienced exponential growth in recent years. However, with this growth also come challenges, especially when it comes to cross-border transactions. Epay provides appropriate payment solutions to help solve payment difficulties, increase customer acquisition, and increase sales.

With Epay, e-commerce businesses can accept payments in multiple currencies, allowing them to reach customers around the world. In addition, Epay offers CNY settlement services, allowing cross-border merchants to transact seamlessly with customers in China.

Solutions for social media platforms

Social media platforms have become an important channel for businesses to interact with their customers and conduct business transactions. However, payment processing can be a challenge, especially when it comes to international payments.

Epay offers a solution to this problem. With Epay, beneficiaries in different countries can receive money through a local bank or pick it up in cash with a favorable exchange rate and low costs. This facilitates financial transactions on social media platforms and improves the user experience.

Solutions for people abroad

Epay not only serves businesses, but also individuals abroad who study, travel, trade, emigrate, and work abroad. Epay is the comprehensive cross-border payment service provider for these individuals, offering a safe and convenient way to conduct financial transactions while abroad.

How to implement Epay on your website

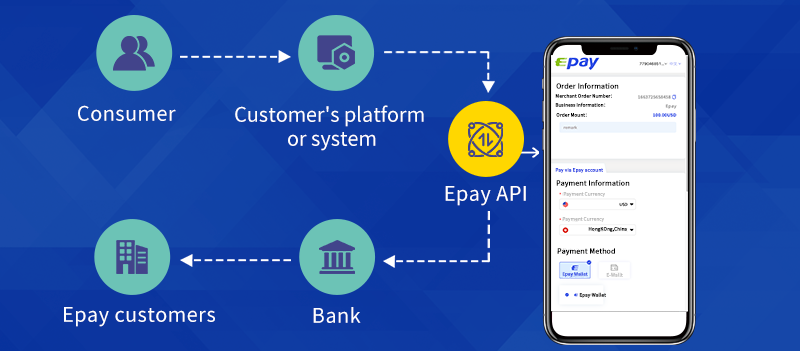

Implementing Epay on your website can be a simple and straightforward process thanks to its API Gateway. This API can quickly provide payment and withdrawal services for your e-commerce websites and mobile applications. Here’s how you can do it.

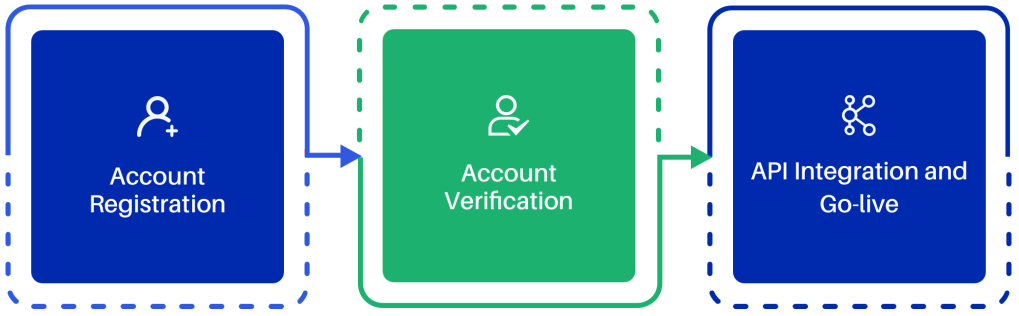

Preparation

Before starting the implementation, you will need to request a connection to the Epay gateway. Once you have applied and been approved, you can enjoy a convenient and efficient transfer process. The scope of services covers more than 200 countries and regions worldwide.

Using the Epay API Gateway

The Epay API Gateway allows you to integrate and build your own payment system. You can use the API to perform automatic batch deposits and withdrawals. Epay provides professional API docking technology services throughout the process. It can be fully customized to your business needs and provide you with the best automatic payment scheme.

Payment channels

Epay offers several payment channels that you can integrate into your website, including domestic transfers (local banks), e-wallet, cash, and international bank transfer.

API integration

To integrate the Epay API into your website, you will need to follow the instructions provided in the Epay API documentation. This includes generating an API key, signing the API, and creating a request form. You can find more details on these steps in the Epay API documentation. If you are unsure or need integration specialists for your website, do not hesitate to contact us. Our developers take care of the entire implementation directly on your website.

In summary, implementing Epay on your website can be a simple and straightforward process. With its API Gateway, you can easily integrate Epay’s payment and withdrawal services into your website or mobile application. This can not only improve the user experience, but also help you expand your business to new global markets.